Global Overview of Economic Growth

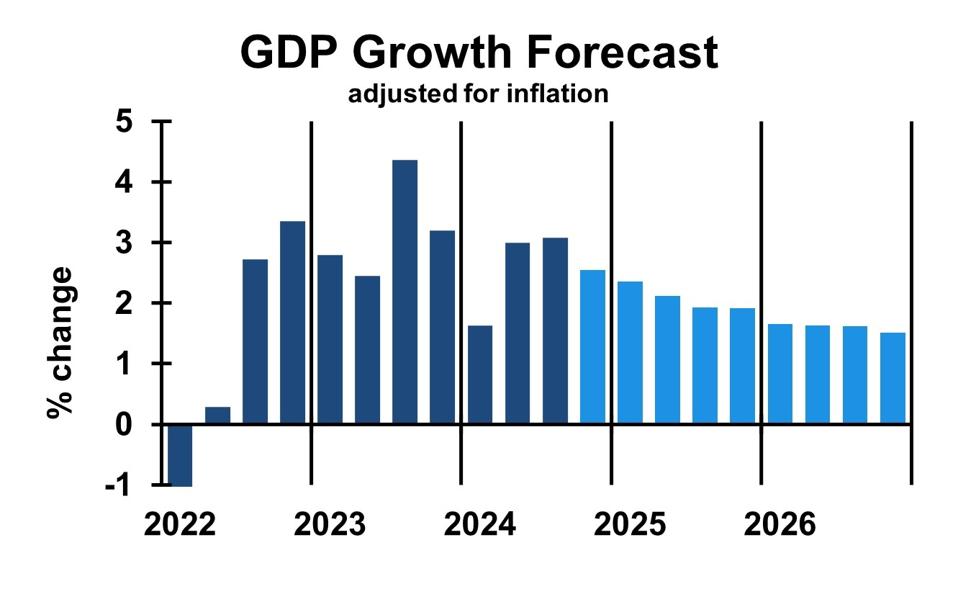

Economic growth continues to be a central topic in global discussions as nations navigate post-pandemic recovery, technological transformation, and shifting geopolitical dynamics. According to leading financial institutions, the world economy is projected to grow modestly in 2025, driven by steady consumption, investment in green technologies, and resilient labor markets. However, challenges such as inflation persistence and high borrowing costs continue to weigh on growth prospects.

Advanced economies like the United States and members of the Eurozone are expected to experience slower expansion compared to emerging markets. The International Monetary Fund (IMF) estimates that global GDP growth will stabilize around 3.2%, reflecting a cautious but steady outlook.

Read Also: Peran Pemda dalam Strategi Menjaga Warisan Budaya Lokal

United States: A Moderating Yet Stable Expansion

The U.S. economy remains one of the most closely watched due to its influence on global trade and investment. Forecasts suggest a moderation of growth to around 2.1% in 2025, compared to 2.5% in the previous year. Factors contributing to this slowdown include tighter monetary policies by the Federal Reserve and a cooling labor market.

Despite the slower pace, strong consumer spending and the resurgence of manufacturing, supported by incentives from the Inflation Reduction Act, will continue to sustain economic momentum. Business investment in clean energy and semiconductor production is expected to offset the impact of reduced household demand.

Moreover, the digital transformation across industries—from finance to healthcare—is creating new opportunities for productivity gains. As the U.S. transitions toward more sustainable and tech-driven growth, analysts predict that inflation will gradually ease to 2.3%, aligning closer to the Fed’s long-term target.

Eurozone: Balancing Recovery and Fiscal Discipline

Europe’s economic growth forecasts remain mixed as member states juggle recovery measures with strict fiscal discipline. The Eurozone is projected to grow by approximately 1.6% in 2025, slightly higher than 2024’s performance. Germany and France will likely lead this modest recovery, driven by exports, innovation in green technology, and improved energy stability.

However, inflationary pressures and high energy costs remain significant challenges. The European Central Bank (ECB) is expected to maintain cautious rate cuts to support investment without reigniting inflation. Southern European countries such as Spain and Italy may experience stronger growth, thanks to tourism recovery and EU-funded infrastructure projects.

The EU’s long-term strategy focuses on digitalization, sustainable energy, and labor market reforms, positioning the region for more stable expansion in the next decade.

Read Also: UNESCO dan Konvensi Pelestarian Budaya Dunia

China: Shifting Toward Domestic Demand

China’s growth outlook shows signs of gradual normalization as the nation rebalances from export-led growth to domestic consumption. The Chinese economy is forecast to grow by around 4.5% in 2025, supported by government stimulus and a revival in real estate investment.

Beijing’s policy direction focuses on boosting consumer confidence, developing high-tech industries, and promoting innovation in renewable energy sectors. Yet, challenges persist—particularly in addressing property market instability and local government debt.

Analysts highlight that the “Made in China 2025” initiative continues to yield results in areas such as electric vehicles, artificial intelligence, and semiconductor production. These sectors not only enhance productivity but also reduce China’s reliance on global supply chains.

Emerging Markets: Growth Driven by Resilience

Emerging economies, particularly in Asia, Africa, and Latin America, are projected to outperform advanced economies in 2025. India, for example, is expected to grow at an impressive rate of 6.6%, supported by digitalization, infrastructure expansion, and strong domestic demand. Southeast Asian countries such as Indonesia and Vietnam are also set to record solid growth above 5%, benefiting from trade diversification and foreign investment inflows.

Latin America, while facing fiscal constraints, will see moderate recovery driven by commodities and renewable energy exports. African economies, particularly Nigeria and Kenya, are leveraging technological innovation and entrepreneurship to boost productivity.

However, these markets face external risks, including currency volatility, debt burdens, and climate-related challenges. Sustainable investment and regional cooperation are essential to maintain their upward trajectory.

Japan and South Korea: Stability Amid Global Uncertainty

Japan’s growth projection stands at 1.4%, reflecting stable domestic demand and ongoing structural reforms. The Bank of Japan’s gradual exit from ultra-loose monetary policy aims to stabilize inflation while supporting consumer confidence.

South Korea, on the other hand, is expected to grow by 2.3%, thanks to strong exports in semiconductors and electric vehicles. Both nations continue to invest heavily in research and innovation, especially in areas like robotics and advanced manufacturing, positioning them as key players in Asia’s technological future.

The two countries’ resilience also benefits from strategic trade partnerships and diversification of supply chains away from geopolitical tensions.

Global Outlook: Opportunities Amid Challenges

While growth forecasts vary across regions, one theme remains consistent: adaptability. Economies that embrace technological innovation, sustainable policies, and inclusive growth models are better positioned to thrive. The ongoing green transition and digital economy are reshaping industries, offering opportunities for nations ready to adapt.

Policymakers worldwide face a delicate balancing act—stimulating growth while maintaining price stability and fiscal responsibility. With coordinated global efforts, 2025 could mark a pivotal step toward a more resilient and equitable world economy.