Trade tensions between global powers are creating significant challenges for emerging markets. As tariffs rise and supply chains face disruption, these economies experience both direct and indirect impacts that influence growth, investment, and social stability. Understanding the geopolitical dimension is critical to analyzing how emerging markets can navigate the current uncertainty.

Geopolitical Impacts

Emerging markets often get caught in geopolitical conflicts. Trade wars between major economies, such as the United States and China, ripple across regions. They affect commodity prices, investment flows, and currency stability. Countries that rely heavily on exports face immediate pressure. Demand slows, and tariffs increase costs. For example, nations exporting electronics, agricultural goods, or raw materials may see revenue drop sharply. Governments then must adjust policies to maintain economic balance.

Political alliances also influence outcomes. Emerging economies with strong diplomatic ties to both sides of a trade dispute can negotiate favorable trade terms. Those without strategic positioning face limited bargaining power. They remain vulnerable to economic shocks. Regional organizations, like ASEAN and Mercosur, attempt to reduce risks by promoting intra-regional trade agreements. However, these efforts cannot fully counter global pressures.

Currency volatility represents another geopolitical challenge. Trade tensions often trigger capital flight from emerging markets, resulting in sudden currency depreciation. This scenario increases import costs and inflation, further straining local populations. Governments may intervene with monetary policies, but frequent interventions can undermine investor confidence and limit policy effectiveness.

Additionally, trade disputes influence foreign direct investment (FDI). Multinational companies may reconsider expansion plans or relocate production to avoid tariffs, which can either benefit alternative emerging markets or deprive them of potential growth opportunities. Countries that fail to offer a stable investment environment risk losing long-term economic gains, exacerbating inequality and social tension. Read Also: Lembaga Swadaya Masyarakat Menjaga Warisan Lokal Sejak Dini

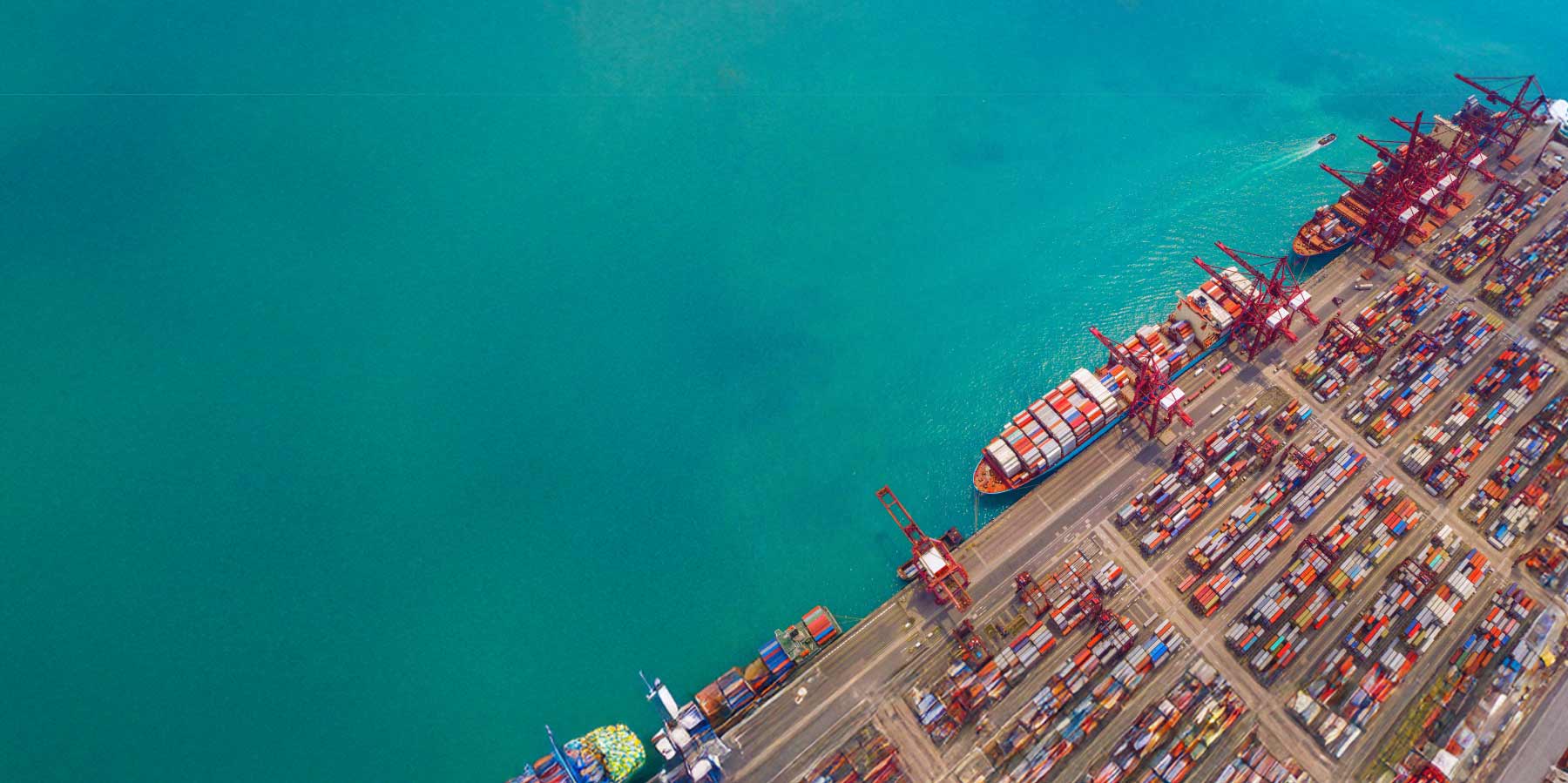

Global supply chains highlight another geopolitical vulnerability. Emerging markets that act as manufacturing hubs for larger economies are particularly exposed when trade barriers disrupt production. Delays, increased shipping costs, and raw material shortages directly affect domestic industries. Policymakers may respond by diversifying suppliers or incentivizing local production, yet such strategies require time and investment to yield tangible results.

In the social arena, trade tensions can indirectly affect labor markets. Rising costs for goods may force companies to reduce workforce or halt expansion projects. Economic uncertainty can also trigger public dissatisfaction, leading to political instability. Governments must therefore balance international negotiations with domestic welfare, emphasizing social safety nets to mitigate the negative effects of external trade conflicts. Read Also: Warisan Komunitas: Belajar Budaya untuk Pelestarian Lokal

Emerging markets must adopt proactive strategies to navigate these geopolitical challenges. Diversification of trade partners, strengthening domestic industries, and fostering regional cooperation can reduce dependency on any single economic power. Moreover, maintaining transparent and predictable policies enhances investor confidence, helping emerging markets withstand global shocks more effectively.

In conclusion, trade tensions exert multifaceted pressures on emerging markets, from economic slowdowns to social and political strain. By recognizing the geopolitical dimensions and implementing strategic measures, these economies can better manage risks and capitalize on opportunities in an increasingly complex global trade environment.