Business Risk Management in a Changing Economy

Introduction

Businesses face uncertainty as the global economy constantly evolves. Shifts in market trends, consumer behavior, and financial conditions create risks that demand strategic planning. Effective business risk management helps companies adapt, safeguard resources, and remain competitive in unpredictable environments.

Understanding Business Risk Management

Business risk management involves identifying, assessing, and addressing potential threats that can disrupt operations or reduce profitability. Leaders must analyze external factors such as inflation, interest rate changes, and supply chain disruptions. Internal challenges like poor cash flow management, weak compliance, and lack of innovation also require attention. By recognizing risks early, organizations can implement strategies that reduce impact and foster resilience.

Business Risk Management and Key Economic Threats

Several risks stand out in the current economic climate.

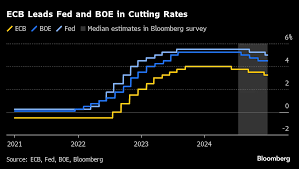

- Financial Risks: Volatile markets and fluctuating currencies can affect profits.

- Operational Risks: Technology failures or supply chain breakdowns can halt production.

- Strategic Risks: Competitors may innovate faster, leaving businesses behind.

- Regulatory Risks: Governments frequently update compliance requirements, adding pressure on companies.

Firms that stay alert to these risks gain the flexibility to pivot quickly and protect long-term growth. Read Also: Menjaga Warisan Griot Afrika Barat dan Tradisi Lisan yang Hidup

Effective Business Risk Management Strategies

To thrive in a shifting economy, companies must adopt proactive strategies.

- Diversify Revenue Streams: Relying on one market or product increases vulnerability. Businesses that expand offerings spread risk more effectively.

- Strengthen Financial Reserves: Maintaining liquidity allows companies to survive downturns and seize opportunities.

- Embrace Technology: Digital tools improve forecasting, streamline operations, and enhance customer engagement.

- Develop Contingency Plans: Scenario planning equips leaders to respond quickly when unexpected disruptions occur.

Leadership and Business Risk Management

Strong leadership drives effective business risk management. Executives must foster a culture of adaptability and accountability. Clear communication ensures every team member understands their role in managing risk. Leaders who prioritize transparency and innovation guide organizations through turbulent times. Read Also: Sejarah Digital: Kunci Pelestarian Warisan dan Sejarah Lokal Kita

Continuous Monitoring for Business Risk Management

The economy never stands still, and neither should business risk management. Continuous monitoring allows organizations to detect shifts early. Businesses that use real-time data analytics gain valuable insights into consumer preferences, market fluctuations, and regulatory updates. This approach keeps risk strategies relevant and effective.

Building Resilience Through Business Risk Management

Risk management is not just about avoiding losses—it’s about building resilience. Companies that adapt, innovate, and plan for uncertainty strengthen their competitive edge. Resilient organizations maintain customer trust, attract investors, and secure sustainable growth even in volatile conditions. Read Also: Teknologi Digital untuk Pelestarian Sejarah Lokal

Conclusion

Business risk management in a changing economy requires foresight, strategy, and adaptability. Companies that diversify, leverage technology, and empower leadership can navigate uncertainty with confidence. Risk management is no longer optional—it is a core driver of long-term success.