Stablecoin Rollout to Begin with Banks South Korea

South Korea will introduce a stablecoin tied to the Korean won through a phased approach. Senior Deputy Governor of the Bank of Korea, Ryoo Sang-dai, confirmed that commercial banks will lead the initial rollout due to their strict regulatory oversight.

Ryoo emphasized the importance of starting with banks before allowing non-bank institutions to issue stablecoins. “It’s preferable to begin with highly regulated banks and then gradually expand to non-bank sectors,” he stated.

Regulatory Strategy and Market Safeguards

Stablecoins, typically pegged 1:1 to major fiat currencies like the US dollar, serve as a key asset in digital finance. They’re used extensively for transferring value between tokens and are gaining traction in traditional financial markets.

Ryoo noted that launching a won-based stablecoin could significantly impact monetary policy and transaction settlements. He stressed the need for safeguards to prevent financial market disruptions and ensure user protection—concerns also raised by Governor Rhee Chang-yong.

Presidential Support and Legislative Push South Korea

President Lee Jae-myung appears committed to fulfilling his campaign promise of supporting stablecoin issuance. South Korea’s Democratic Party has proposed legislation to create the necessary regulatory infrastructure, aiming to prevent the country from lagging behind global fintech developments.

CBDC Trials and Digital Reforms

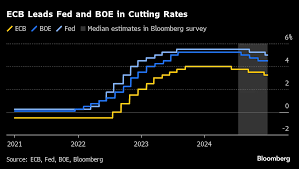

Ryoo also acknowledged that housing prices and household debt currently weigh heavily on central bank policy. South Korea is now in a rate-cutting cycle, with the latest cut placing interest rates within the neutral range.

Meanwhile, the Bank of Korea is preparing for the second phase of its central bank digital currency (CBDC) pilot. This follows an initial trial launched in collaboration with the Bank for International Settlements, expected to conclude next week.

Opening Currency Markets to Foreign Investors

In line with global digitalization trends, South Korean authorities plan to accelerate market reforms. These include efforts to make the won more accessible to foreign investors by extending trading hours and easing participation rules—part of a broader move to modernize South Korea’s financial ecosystem.