The latest ECB interest rate decision kept rates on hold for the third consecutive meeting, reflecting a cautious stance amid ongoing inflation in the eurozone. Meanwhile, the Bank of Japan (BOJ) startled global markets with a long-awaited adjustment to its ultra-loose monetary policy. These differing responses to inflation and growth illustrate how two of the world’s major central banks are charting divergent paths.

Interest Rates: ECB Holds, BOJ Starts to Shift

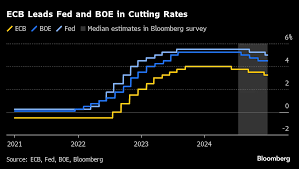

The European Central Bank kept its deposit rate at 4.25%. This signals confidence that current levels are restrictive enough to guide inflation toward target. Although consumer prices have eased, ECB officials remain cautious about core inflation, especially in services.

Meanwhile, the BOJ made a notable adjustment to its yield curve control. It expanded the cap on 10-year Japanese government bond yields to ±1%. This move marks a cautious step toward policy normalization after decades of accommodative measures to combat deflation and stimulate growth.

Monetary Policy Paths: Stability Versus Transition

The ECB interest rate decision reflects a strategic pause as policymakers monitor the delayed effects of previous rate hikes. President Christine Lagarde stressed the importance of remaining data-dependent and avoided signaling a firm path forward, keeping all options open for future meetings.

In contrast, the BOJ’s latest move suggests it may be preparing for a slow exit from its unconventional monetary stance. Governor Kazuo Ueda emphasized that the policy tweak does not mark the start of a rate-hiking cycle but rather enhances the flexibility of Japan’s monetary framework.

Inflation Outlook: Persistent in Europe, Accelerating in Japan

The ECB expects eurozone inflation to average 3.2% in 2025, still above the 2% target. While energy inflation has moderated, food and services inflation remain sticky. The central bank faces a dilemma: raise rates further and risk recession, or hold and risk inflation persistence.

Japan faces a different situation. After decades of deflation, consumer prices have steadily climbed, with inflation staying above 3% for over a year. Major corporations have responded with wage increases—another sign of structural inflation taking root. The BOJ now faces the challenge of maintaining price stability without derailing the fragile recovery.

Market Reactions to Central Bank Announcements

Financial markets reacted calmly to the ECB interest rate decision, with minimal movement in bond yields and a slight dip in the euro. Investors had anticipated a hold and are now watching closely for signals ahead of the September meeting.

In Japan, the BOJ’s policy shift caused a surge in bond yields and temporary gains for the yen. Japanese equities slipped as traders priced in tighter financial conditions. Global investors interpreted the change as a signal that Japan is slowly preparing to normalize, though at a measured pace.

Conclusion

The ECB interest rate decision and the BOJ’s surprise shift emphasize how inflation and economic conditions continue to shape central bank strategies in different ways. While Europe chooses restraint and careful observation, Japan inches toward ending a historic era of ultra-loose policy. As the global economic landscape evolves, these policy divergences will shape everything from bond markets to currency flows in the months ahead.