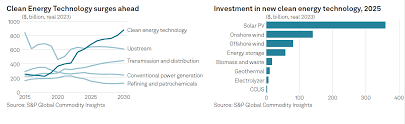

As global focus on sustainability intensifies, investing in renewable energy commodities in 2025 has become a top priority for forward-looking investors. The demand for solar, wind, and battery-related materials continues to rise, fueled by technological innovation and government incentives. These commodities not only support a greener planet but also present strong financial potential for those seeking long-term growth in the energy sector.

Renewable Energy Market Trends

The renewable energy sector has shown remarkable resilience despite global economic fluctuations. Solar, wind, and battery technologies are evolving rapidly, reducing production costs while increasing efficiency. Solar energy, in particular, has expanded in both residential and industrial applications, making solar-related commodities an appealing investment. Similarly, lithium, cobalt, and rare earth metals remain essential for battery storage systems, creating consistent demand. Investors should monitor policy changes and market developments closely to maximize returns.

Read Also: Generasi Muda Penjaga Warisan: Inisiatif Pelestarian Budaya

Key Commodities in Renewable Energy

Several commodities drive the renewable energy industry. Solar-grade polysilicon, copper for electrical wiring, and aluminum for wind turbine components remain in high demand. Lithium and cobalt dominate the battery sector, while silicon carbide sees growing use in electric vehicles and power electronics. Investors can diversify portfolios by combining these commodities, balancing high-growth opportunities with stable, long-term assets. Understanding supply chain risks and global market trends is crucial for informed decision-making in this sector.

Read Also: Aplikasi Edukasi Budaya untuk Belajar Tradisi Nusantara

Environmental and Economic Impacts

Investing in renewable energy commodities delivers more than financial benefits. By supporting green technologies, investors help reduce carbon emissions and promote sustainable infrastructure. Renewable energy projects create jobs, drive local economies, and encourage technological innovation. Countries transitioning from fossil fuels to clean energy witness a reduction in environmental degradation, which can stabilize markets over the long term. This dual impact makes renewable energy commodities both ethically and economically compelling.

Read Also: Pendidikan Informal Komunitas dalam Pelestarian Budaya

Strategies for Investing

Investors can approach renewable energy commodities in multiple ways. Direct commodity trading, investing in exchange-traded funds (ETFs), or buying stocks of companies producing renewable technology all provide avenues for growth. Risk management is essential, as market volatility can affect short-term gains. Diversifying across regions, technologies, and commodity types can help stabilize returns. Monitoring government incentives, sustainability initiatives, and technological advancements allows investors to capitalize on emerging opportunities efficiently.

Outlook for 2025 and Beyond

Looking ahead, renewable energy commodities are poised for continued growth. Increasing global awareness of climate change, along with supportive policies from major economies, underpins the sector’s expansion. Innovation in energy storage, grid management, and smart infrastructure promises to enhance the value of related commodities. Investors who act strategically and remain informed will likely benefit from both economic gains and contributions to a sustainable future.